Mileage Reimbursement

State Controller Policy

Effective Date: 07/1/2023

Updated: 7/17/2024

Approved by: Robert Jaros, CPA, MBA, JD, Colorado State Controller

Policy

When an employee uses his/her personal vehicle while on State Business, the employee shall be reimbursed for an amount equal to the prevailing mileage rate established by the Colorado General Assembly, multiplied by either the allowable miles as outlined below or under a mileage reimbursement policy adopted by the employee’s Institution of Higher Education.

Definitions

- See Fiscal Rule 5-1, §2 Definitions and Flexible Work Arrangements Fiscal Policy.

- Regular Agency Work Location – State Headquarters Work Location for an employee’s agency for an employee who does not have a Regular Work Location. Fiscal Rule 5-1, 2.25. Under this policy, Regular Agency Work Location also includes a Regional Office location as deemed appropriate by the appointing authority.

Applicability of this Policy

When this policy applies to employees who use their personal vehicle to travel on State Business. This policy applies to both transportation expenses and travel expenses. Employees who use a State-owned vehicle are not eligible for mileage reimbursement.

Prevailing Mileage Rate

- Colorado Statute - CRS §24-9-104(2) establishes the mileage rate to be used for reimbursement of travel while on State Business.

Percentage of Prevailing Internal Revenue Service (IRS) Rate - CRS §24-9-104(d) provides that on and after January 1, 2008, State officers and employees shall be allowed a mileage reimbursement of 90% of the prevailing IRS rate per mile for each mile actually and necessarily traveled while authorized to travel on State Business (to the nearest cent) where the employee operates vehicle on paved roads. - 95% of the prevailing IRS rate per mile for each mile actually and necessarily traveled while authorized on State Business (to the nearest cent) for four-wheel-drive vehicles that are necessary for State Business that requires the employee to operate a vehicle away from public roads such as no road or unpaved ground.

- Reimbursement for 2WHD and 4WHD

- Mileage Reimbursement – Mileage reimbursement at the 4-wheel drive rate is limited to instances when either:

- The Colorado Department of Transportation (CDOT) deems a 4-wheel drive vehicle is required through activation of either the “Traction Law” or “Passenger Vehicle Chain Law”. Reimbursement at the 4-wheel drive rate is limited to the portion of the trip where CDOT has activated either law. A “weather advisory” or use of a personal 4-wheel or all-wheel drive vehicle does not require reimbursement at the 4-wheel drive rate.

- Use of 4-wheel drive is necessary because of travel over unpaved road or rough terrain.

- Pursuant to Section 24-9-104(2)(e), C.R.S., “four-wheel-drive vehicles” means sport utility vehicles and pick-up trucks with a 4WHD transmission system. “Four-wheel-drive vehicles” does not include standard vehicles with all-wheel-drive capability.

- Mileage Reimbursement – Mileage reimbursement at the 4-wheel drive rate is limited to instances when either:

- Current Mileage Rate - The current mileage rate is posted on the Travel Fiscal Rule webpage of the Office of the State Controller.

Mileage Reimbursement for Electric Vehicles

Until the IRS issues guidance, State agencies shall follow this Policy and reimburse employees with electric vehicles the same as employee’s with gasoline powered vehicles.

Mileage Reimbursement

- Mileage reimbursement shall be equal to the eligible miles in accordance with this policy multiplied by the prevailing mileage rate.

- An employee shall receive mileage reimbursement in accordance with this policy for travel within an outside of a Metropolitan Area.

Applicability of Mileage Reimbursement Tables

- The Mileage Reimbursement Tables apply to employees working in a Remote Workplace, Hybrid Workplace, or State Workplace.

- The Mileage Reimbursement Tables apply both to and from for each scenario. For instance, the table includes travel from and Employee’s Residence to a State Workplace. The same reimbursement and mileage applies for travel from a State Workplace to an Employee’s Residence.

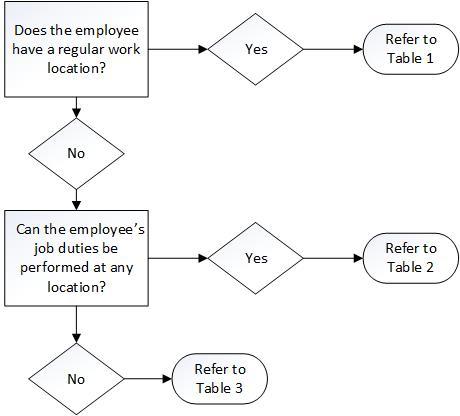

- The distinction between Mileage Reimbursement Table #1, #2, and #3 is as Follows:

- Table #1 applies to employees who have a Regular Work Location. Commuting Miles is the distance between an Employee’s Residence and an Employee’s Regular Work Location.

- Table #2 applies to employees who do not have Regular Work Location and the employee’s job duties can be performed at any location or within the Denver Metropolitan Area.

- Table #3 applies to employees who do not have a Regular Work Location and the employee’s job duties can be performed only in a particular geographic area outside the Denver Metropolitan Area and the employee was hired to perform those work duties in that geographic area.

Table 1

Employees who have a Regular Work Location

Table 1 Example | Travel from: | Travel to: | Reimbursement Allowed? | Mileage |

1.1 | Employee’s Residence | State Workplace – employee’s regular work location | No | No |

1.2 | Employee’s Residence | State Workplace other than employee’s regular work location to carry out employee’s duties such as inspections and oversight of staff at other locations. | Yes | Employee’s Residence to Other State Workplace less Commuting Miles |

1.3 | Employee’s Residence | Location other than State Workplace within Metropolitan Area | Yes | Employee’s Residence to location in Metropolitan Area less Commuting Miles |

1.4 | Employee’s Residence | Location other than State Workplace outside Metropolitan Area | Yes | Employee’s Residence to location outside Metropolitan Area less Commuting Miles |

1.5 | Employee’s Residence | Temporary Work Location | Yes | Employee’s Residence to Temporary Work Location less Commuting Miles |

1.6 | Employee’s Residence | Conferences, meetings, training sessions and other business-related activities held in a State Workplace within the Metropolitan Area | Yes | Employee’s Residence to Conference in a State Workplace in the Metropolitan Area less Commuting Miles |

1.7 | Employee’s Residence | Conferences, meetings, training sessions and other business-related activities held in a State Workplace outside the Metropolitan Area | Yes | Employee’s Residence to Conference in a State Workplace outside the Metropolitan Area less Commuting Miles |

1.8 | Employee’s Residence | Conferences, meetings, training sessions and other business-related activities held in a non-State Workplace | Yes | Employee’s Residence to Conference in a non-State Workplace less Commuting Miles |

1.9 | Employee’s Residence | Airport | Yes | Employee’s Residence to Airport less Commuting Miles |

1.10 | Employee’s Residence | Employer’s business to carry out State purpose such as inspections when there is a State Workplace | Yes | Employee’s Residence to Employer’s business less Commuting Miles |

1.11 | Employee’s Residence | Employer’s business to carry out State purpose such as inspections when there is no State Workplace | Yes | Employee’s Residence to Employer’s business less Commuting Miles |

1.12 | State Workplace #1 | State Workplace #2 not a temporary work location within Metropolitan Area | Yes | State Workplace #1 to State Workplace #2 |

1.13 | State Workplace #1 | State Workplace #2 not a temporary work location outside Metropolitan Area | Yes | State Workplace #1 to State Workplace #2 |

1.14 | State Workplace | Employer’s business to carry out State purpose such as inspections | Yes | State Workplace to employer’s business |

1.15 | Employer’s business #1 | Employer’s business #2 to carry out State purpose such as inspections | Yes | Employer’s business #1 to employer’s business #2 |

1.16 | Temporary Work Location #1 | Temporary Work Location #2 | Yes | Temporary Work Location #1 to Temporary Work Location #2 |

Table 2

Employees who do not have a Regular Work Location and the employee's job duties can be performed at their place of residence.

Table 2 Example | Travel from: | Travel to: | Reimbursement Allowed? | Mileage |

2.1 | Employee’s Residence | State Workplace – employee’s agency regular work location | No | No |

2.2 | Employee’s Residence | State Workplace other than employee’s agency regular work location to carry out employee’s duties such as inspections and oversight of staff at other locations. | Yes | Employee’s Residence to Other State Workplace minus 50 miles |

2.3 | Employee’s Residence | Location other than State Workplace within Metropolitan Area | Yes | Employee’s Residence to location in Metropolitan Area minus 50 miles |

2.4 | Employee’s Residence | Location other than State Workplace outside Metropolitan Area | Yes | Employee’s Residence to location outside Metropolitan Area minus 50 miles |

2.5 | Employee’s Residence | Temporary Work Location | Yes | Employee’s Residence to Temporary Work Location minus 50 miles |

2.6 | Employee’s Residence | Conferences, meetings, training sessions and other business-related activities held in a State Workplace within the Metropolitan Area | Yes | Employee’s Residence to Conference in a State Workplace in the Metropolitan Area minus 50 miles |

2.7 | Employee’s Residence | Conferences, meetings, training sessions and other business-related activities held in a State Workplace outside the Metropolitan Area | Yes | Employee’s Residence to Conference in a State Workplace outside the Metropolitan Area minus 50 miles |

2.8 | Employee’s Residence | Conferences, meetings, training sessions and other business-related activities held in a non-State Workplace | Yes | Employee’s Residence to Conference in a non-State Workplace minus 50 miles |

2.9 | Employee’s Residence | Airport | Yes | Employee’s Residence to Airport minus 50 miles |

2.10 | Employee’s Residence | Employer’s business to carry out State purpose such as inspections when there is a State Workplace | Yes | Employee’s Residence to Employer’s business minus 50 miles |

2.11 | Employee’s Residence | Employer’s business to carry out State purpose such as inspections when there is no State Workplace | Yes | Employee’s Residence to Employer’s business minus 50 miles |

2.12 | State Workplace #1 | State Workplace #2 not a temporary work location within Metropolitan Area | Yes | State Workplace #1 to State Workplace #2 |

2.13 | State Workplace #1 | State Workplace #2 not a temporary work location outside Metropolitan Area | Yes | State Workplace #1 to State Workplace #2 |

2.14 | State Workplace | Employer’s business to carry out State purpose such as inspections | Yes | State Workplace to employer’s business |

2.15 | Employer’s business #1 | Employer’s business #2 to carry out State purpose such as inspections | Yes | Employer’s business #1 to employer’s business #2 |

2.16 | Temporary Work Location #1 | Temporary Work Location #2 | Yes | Temporary Work Location #1 to Temporary Work Location #2 |

Note: 50 miles is deducted for each way of the trip

Table 3

Employees who do not have a Regular Work Location and the employee's work duties can be performed only in a particular geographic area outside the Denver Metropolitan Area and the employee was hired to perform those work duties in that geographic area.

Table 3 Example | Travel from: | Travel to: | Reimbursement Allowed? | Mileage |

3.1 | Employee’s Residence | State Workplace – employee’s agency regular work location | No | No |

3.2 | Employee’s Residence | State Workplace other than employee’s agency regular work location to carry out employee’s duties such as inspections and oversight of staff at other locations. | Yes | Employee’s Residence to Other State Workplace |

3.3 | Employee’s Residence | Location other than State Workplace within Metropolitan Area | Yes | Employee’s Residence to location in Metropolitan Area |

3.4 | Employee’s Residence | Location other than State Workplace outside Metropolitan Area | Yes | Employee’s Residence to location outside Metropolitan Area |

3.5 | Employee’s Residence | Temporary Work Location | Yes | Employee’s Residence to Temporary Work Location |

3.6 | Employee’s Residence | Conferences, meetings, training sessions and other business-related activities held in a State Workplace within the Metropolitan Area | Yes | Employee’s Residence to Conference in a State Workplace in the Metropolitan Area |

3.7 | Employee’s Residence | Conferences, meetings, training sessions and other business-related activities held in a State Workplace outside the Metropolitan Area | Yes | Employee’s Residence to Conference in a State Workplace outside the Metropolitan Area |

3.8 | Employee’s Residence | Conferences, meetings, training sessions and other business-related activities held in a non-State Workplace | Yes | Employee’s Residence to Conference in a non-State Workplace |

3.9 | Employee’s Residence | Airport | Yes | Employee’s Residence to Airport |

3.10 | Employee’s Residence | Employer’s business to carry out State purpose such as inspections when there is a State Workplace | Yes | Employee’s Residence to Employer’s business |

3.11 | Employee’s Residence | Employer’s business to carry out State purpose such as inspections when there is no State Workplace | Yes | Employee’s Residence to Employer’s business |

3.12 | State Workplace #1 | State Workplace #2 not a temporary work location within Metropolitan Area | Yes | State Workplace #1 to State Workplace #2 |

3.13 | State Workplace #1 | State Workplace #2 not a temporary work location outside Metropolitan Area | Yes | State Workplace #1 to State Workplace #2 |

3.14 | State Workplace | Employer’s business to carry out State purpose such as inspections | Yes | State Workplace to employer’s business |

3.15 | Employer’s business #1 | Employer’s business #2 to carry out State purpose such as inspections | Yes | Employer’s business #1 to employer’s business #2 |

3.16 | Temporary Work Location #1 | Temporary Work Location #2 | Yes | Temporary Work Location #1 to Temporary Work Location #2 |

Flow Chart for Travel Reimbursement Table