Diagnostic Reports Guide

Introduction

The diagnostic reports are used as a monitoring tool by both the departments and the Office of the State Controller (OSC) for management purposes, in the quarterly reporting process (see Chapter 5, Section 4 for more information on quarterly reporting), and for assuring that departments have completed critical year-end closing processes. The reports can be found in the OSC Diagnostic Folder, unless otherwise noted.

It is the intent of this guide to provide more detailed information on the OSC diagnostic reports including the purpose of each report, the data elements provided on each report, how to interpret each report, and possible follow-up steps that should be taken.

Examples provided are for illustrative purposes only and should not be used as an evaluation of the departments shown. Additionally, the “How to read this report” and “Possible actions include” section present common scenarios. It is possible that they may not apply to all situations. Please contact your department controller or the OSC Financial Specialist assigned to your department for additional assistance interpreting and acting on the OSC diagnostic reports.

Some formatting differences may exist between the example reports provided in this guide and the active reports in infoAdvantage. Additional reports will be added to this guide and it will be updated as changes occur, so check back in the future for updated version of this guide.

| infoAdvantage Report ID | Report Title | Description |

|---|---|---|

| Department Reports Folder | Exhibit J Financial Statement Report | This report provides the State presentation of specific Departments/Funds required to issue stand- alone financial statements. Stand-alone financial statements must be reconciled to this report on the Exhibit J. |

| OSC-001 | Appropriations with $0 Budget | This report identifies appropriation units with expenses and $0 budgets. Departments should record budget or reclassify expenses as necessary. Institutions of Higher Education should reclassify non-appropriated expenses posted by central service departments to non- budgeted posting codes. |

| OSC-002 | Cash Out of Balance on JV1STND, JVC, and CHC Transactions | This report identifies instances where Treasury pooled cash does not net to zero within a single transaction. Report totals should net to $0 by department or by transaction department for transactions crossing cabinets. |

| OSC-003 OSC-003-A OSC-003-B | Abnormal Balances Balance Sheet Account (BSA) – Abnormal Balances Operating – Abnormal Balances | These reports identify abnormal balances and clearing accounts with balances. This report does not include Fund 4710 or 399x, nor does it include deficit cash balances in Fund 1000, 4610, or 4611. Items on this report need to be investigated and generally require correcting entries. The OSC-003-A and OSC-003-B reports are available for departments that prefer to run the balance sheet and operating accounts separately. |

| OSC-004 | TABOR – Nonexempt Revenue Variance Report | This report assists in the evaluation of the accuracy and completeness of TABOR revenue. |

| OSC-006 | Long Bill Operating | This report is updated annually to assist with the review and reconciliation of the booking of the operating section of the long bill. |

| OSC-007 | Long Bill Capital | This report is updated annually to assist with the review and reconciliation of the booking of the capital construction section of the long bill. |

| OSC-008 | Missing Data Elements | This report identifies transactions processed with missing appropriation units, revenue source codes, object codes, funds, departments, and balance sheet accounts. Corrections can be made using the JV1ADVN transaction. |

| OSC-009 | Overexpenditure | This report identifies overexpended line items at the legal level of control. Reports in the budget to actual folder (BA-xxx reports) or the all Long Bill Line Item (LBLI) tab can be used to review budgets at a lower level. |

| OSC-010 | Under Earned Revenue | This report identifies appropriation types with insufficient revenue to cover expenditures in Fund 1000, 4610, or 4611. This report will include fund balance authority as earned revenue via Event Type XG30. Underearned revenue at year-end is reported as an overexpenditure. |

| OSC-011 | IHE Capital Transfers Compared to Expenditures | This report shows mismatches between transfers out of the Capital Construction Fund, and project level expenditures within Higher Education Funds. The BSA 6610 capitalization offset is excluded from this report. |

| OSC-012 | Transfer Balancing - Other Cabinet | This report identifies net out-of-balance conditions for transfers across cabinet. |

| OSC-013 | Transfer Balancing - Same Cabinet | This report identifies net out-of-balance conditions for transfers within the same cabinet. |

| OSC-014 | Transfer Balancing – Higher Education | This report identifies net out-of-balance conditions for transfers across higher education institutions and between institutions and other non-institution departments/cabinets. |

| OSC-015 | IHE Noncapitalizable Emergency Projects | This report compares DPA emergency maintenance funds expenditures and the revenue recorded by higher education institutions. |

| OSC-016 | Unbudgeted Posting Codes | This report contains a summary of unbudgeted expenditures and revenues to allow for identification of potential problems such as improper use of unbudgeted posting codes or missing unbudgeted entries. |

| OSC-017 | TABOR Audit Adjustments | This report is used by the OSC to review entries impacting TABOR. |

| OSC-018 | Exhibit Reconciling Balances | This report assists in the preparation of exhibits required to tie to Colorado Operations Resource Engine (CORE) ending balances. |

OSC-019-A | Capital Construction Reversions and Carryforwards Certificates of Participation (COP) Projects Reversions and Carryforwards | These reports provide a listing of both expiring and continuing capital construction projects. The OSC-019-A also reports total project budget and percentage expended for COP projects. |

| OSC-021 | Split Funded Capital Construction Projects | This report provides a summary of capital construction expenditures expressed as a percentage of the project budget. Projects with multiple funding sources should be spent proportionally. |

| OSC-022 | BFY FY Mismatch Revenues and Expenditures | This report identifies transactions posted with mismatched fiscal year (FY) and budget fiscal year (BFY) values. |

| OSC-023 | Cash Funds Report | This report is used for uncommitted cash fund reserve reporting per 24-71-402, Colorado Revised Statutes (C.R.S.) including the turnaround report and the final statutory report. Departments are encouraged to use this report throughout the year to ensure fee revenues are properly recorded (see Chapter 5, Section 7). |

| OSC-024 | Fund Balance Deficits | This report lists funds with deficit fund balances at the cabinet and department code levels. The second tab on this report shows fund balances for all funds, whether in a deficit position or not. As deficit fund balances are treated as overexpenditures, this report excludes pension and Other Postemployment Benefits (OPEB) balances and OSC use only department codes (department codes with X as the second character). |

| OSC-028 | Budget Augmenting Revenue | This report identifies revenue in excess of expenditures in cash, federal, and reappropriated appropriations in the general fund. |

| OSC-029 | Variance Analysis | Financial statement variance analysis to be used at year-end. This report assists in the evaluation of the accuracy and completeness of CORE balances. |

| OSC-030 | HB20-1426 Federal Funds Turnaround Report | This report identified budgeted expenditures in federal appropriation units, and serves as a turnaround report for the Office of State Planning and Budgeting (OSPB) in its preparation of reporting required by HB20-1426. |

| OSC-031 | Average Daily Cash Deficit Balance by Calendar Months in a Quarter | This report lists average daily cash deficit balances by calendar months in a quarter for funds at the cabinet level, excluding fund 1000, 4610, and 4611. It also includes cash and fund balances by the fiscal quarter-end to assist departments on identifying accounts where an approved loan or advance is or may be required at the end of the fiscal year. |

OSC-001 – Appropriations with $0 Budget

Purpose:

This report identifies appropriation units with budgeted expenses and encumbrances recorded against $0 budgets at level 3 for structures 190 and 191 (BQ190LV3 and BQ191LV3).

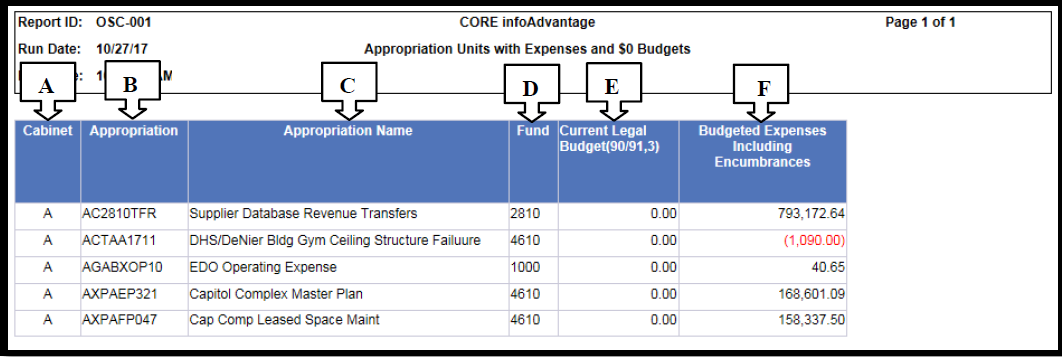

Sample report from infoAdvantage:

The following table describes the information provided on the report:

| Item | Description |

|---|---|

| A | Cabinet: The single character cabinet code. |

| B | Appropriation: The appropriation unit code. |

| C | Appropriation Name: The appropriation unit name from the APPR table. |

| D | Fund: The fund code. |

| E | Current Legal Budget: The current legal budget as of the report run date. |

| F | Budgeted Expenses Including Encumbrances: Total of budgeted expenses and encumbrances as of the report run date. |

How to read this report:

Any item listed on this report is a potential problem. Items listed should be researched and corrected if necessary. Balances may be creating legal overexpenditures and should be reviewed in conjunction with the OSC-009 report.

Possible actions include:

- Reclassify expenses and encumbrances to a different appropriation unit with a budget

- Record budget for the line

- Explain the balance if it is not creating a legal overexpenditure

- Reclassify budgeted expenses to nonbudgeted (if appropriate, e.g. higher education, compensated absences, general fund paydate shift, etc.)

OSC-002 – Cash Out of Balance on JV1STND, JVC & CHC Transactions

Purpose:

This report identifies instances where cash does not net to zero within a single transaction. Sample report from infoAdvantage:

The following table describes the information provided on the report:

| Item | Description |

|---|---|

| A | Cabinet: The single character cabinet code and cabinet name. |

| B | Jrnl Doc: The journal transaction (code, department, ID number, version). |

| C | AP: The accounting period the Jrnl Doc posted to. |

| D | Jrnl Debit Amt: The total debits posted to posting code A001 - Cash. |

| E | Jrnl Credit Amt: The total credits posted to posting code A001 - Cash. |

| F | Net: Net debits and credits posted to posting code A001 – Cash. |

How to read this report:

Report totals should equal $0.00. Any item listed on this report is a potential problem creating a reconciling item for Treasury. Items listed should be researched and corrected if necessary.

Possible actions include:

- Reverse the entry and post using the correct transaction

- Modify the entry or record another entry to balance cash

- Explain the balance

OSC-003 – Abnormal Balances

OSC-003-A BSA – Abnormal Balances

OSC-003-B Operating – Abnormal Balances

Purpose:

These reports identify abnormal balances and clearing accounts with balances. These reports do not include Fund 4710 or 399x; deficit cash balances in Fund 1000, 4610, or 4611; nor Balance Sheet Account (BSA) 1043, 4031, 4032, 5031, 5032. The OSC-003-A and OSC-003-B contain the same information as the OSC-003 combined report and are available in the event the OSC-003 combined report times out due to a large number of records.

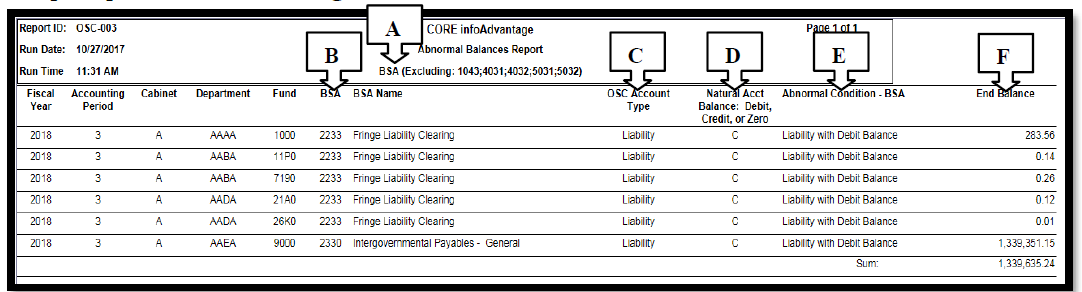

Sample report from infoAdvantage:

The following table describes the information provided on the report:

| Item | Description |

|---|---|

| A | BSA: The subtitle of the report displayed (BSA, Cash, Object, or Revenue). |

| B | BSA: The account code and name (BSA, Object, or Revenue). |

| C | OSC Account Type: The account type of Item B above (only applicable to BSA and Cash reports). |

| D | Natural Acct Balance: The natural account balance for Item B above defined in account rollups (BSA Type, Object Type, Revenue Type). |

| E | Abnormal Condition: Brief description of the type of abnormal balance. |

| F | End Balance: Ending balance for the account for the accounting period. |

How to read this report:

Any item listed on this report is a potential problem. Items listed on the report should be researched and any necessary corrections should be made. The department should be prepared to explain any balances remaining at the end of the fiscal year (FY) to either the Office of the State Controller (OSC) or the department’s auditors.

Possible actions include:

- Record an entry to correct the balance

- Explain the balance

OSC-004 – TABOR – Nonexempt Revenue Variance Report

Purpose:

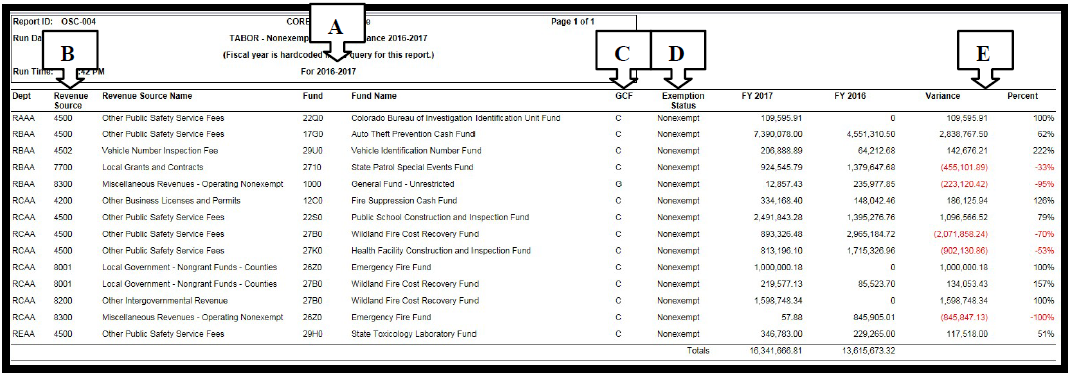

This report assists in the evaluation of the accuracy and completeness of Taxpayer's Bill of Rights (TABOR) revenue. Variance analysis explanations are due to the OSC by the date provided in the annual open/close calendar to support the annual TABOR report. Sample report from infoAdvantage:

The following table describes the information provided on the report:

| Item | Description |

|---|---|

| A | For: The two years being compared. |

| B | Revenue Source: The revenue source code of the variance. |

| C | GCF: General – General Purpose Revenue in fund 1000, Cash – Cash revenue, Federal – Federal revenue. |

| D | Exemption Status: TABOR exemption status. |

How to read this report:

This report should be used throughout the year, but especially during the last quarter and year end close to identify potential issues with TABOR revenue balances. Variances on the “Variance with Filters” tab will need to be explained by the date on the annual open/close calendar. The OSC provides instructions for responding to this report each fiscal year end close.

Possible actions include:

- Record an entry to correct TABOR revenue

- Provide explanations for material variances in accordance with the guidance provided by the OSC each year

OSC-006 – Long Bill Operating & OSC-007 – Long Bill Capital

Purpose:

These reports are updated annually to assist with review and reconciliation of the booking of the long bill. Multiple tabs are provided on this report to review the long bill booking at the cabinet, group, line, and category levels of control. Sample report from infoAdvantage:

The following table describes the information provided on the report:

| Item | Description |

|---|---|

| A | Group Level: The level of control viewed on this tab of the report. |

| B | Group: Long bill group code (available from the coded long bill distributed by the OSC to departments). |

| C | G/X/C/R/F: The amount booked in each funding source (General, General Exempt, Cash, Reappropriated, Federal). |

How to read this report:

Amounts on the cabinet, group, and line tabs of the report can be compared to the adopted long bill. Group and line coding is provided by the OSC to departments on the coded long bill distributed after it is interfaced from Performance Budgeting (PB) to Colorado Operations Resource Engine (CORE). The instructions and cover page tabs provide additional information on the spending authority indicator and appropriation types included on each report.

Possible actions include:

- Compare reports to adopted long bill

- Contact the Financial Services Unit to resolve any differences or questions

OSC-008 – Missing Data Elements

Purpose:

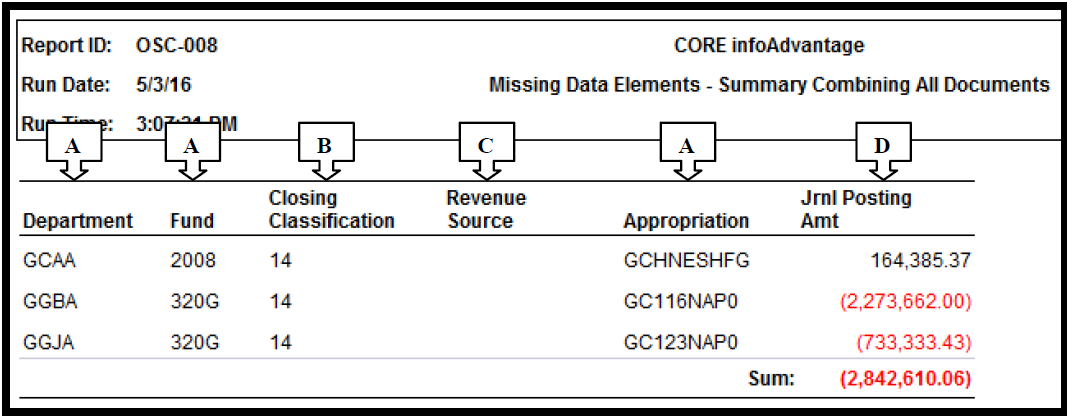

This report identifies transactions processed without key data elements such as appropriation units, revenue source codes, object codes, funds, departments, and balance sheet accounts. Sample report from infoAdvantage:

The following table describes the information provided on the report:

| Item | Description |

|---|---|

| A | Chart of account elements: The known chart of accounts associated with the balance. |

| B | Closing Classification: The closing classification of the balance missing the data element. |

| C | Missing data element: Blank column indicating the missing data element. |

| D | Jrnl Posting Amt: The net debits and credits posted without the data element. |

How to read this report:

Any item listed on this report is a problem. Items listed on the report should be researched and any necessary corrections should be made.

Possible actions include:

Record an entry to correct the balance. Corrections are usually entered on a JV1ADVN transaction.

OSC-009 – Overexpenditure

Purpose:

This report identifies overexpended line items at the legal level of control. This report lists budget overexpenditures. The OSC-010 report lists overexpenditures caused by underearned revenue.

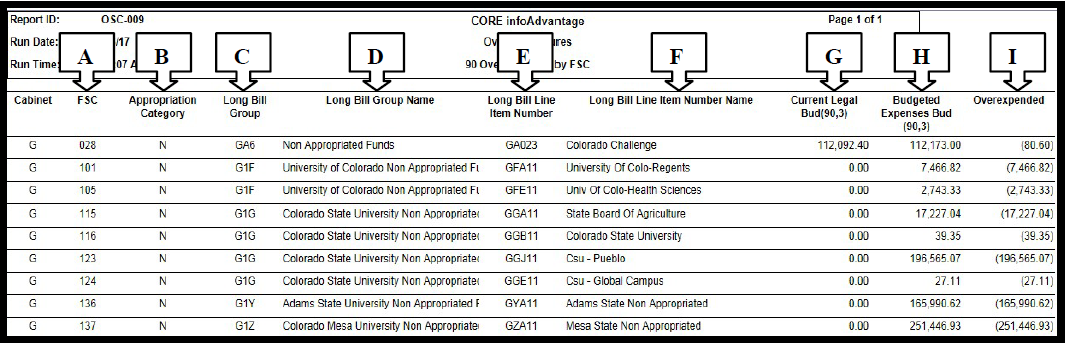

Sample report from infoAdvantage:

The following table describes the information provided on the report:

| Item | Description |

|---|---|

| A | FSC: Funding source code (last three characters of appropriation type code). |

| B | Appropriation Category: The appropriation category of this budget line. |

| C | Long Bill Group: Last three characters of appropriation group code. |

| D | Long Bill Group Name: Appropriation group code name. |

| E | Long Bill Line Item Number: Last four characters of appropriation class code. |

| F | Long Bill Line Item Number Name: Appropriation class code name. |

| G | Current Legal Bud: Legal budget as of the report run date. |

| H | Budgeted Expenses Bud: Budgeted expenses as of the report run date. |

| I | Overexpended: Budgeted expenses in excess of current legal budget. |

How to read this report:

Any item listed on this report is a problem. Items listed on the report should be researched and any necessary corrections should be made.

Possible actions include:

- Reclassify expenses to another budget line

- Reclassify budgeted expenses to nonbudgeted (if appropriate, e.g. higher education, compensated absences, general fund paydate shift, etc.)

- Evaluate for eligibility for like-purpose appropriation transfer (24-75-108, C.R.S.)

- Submit an overexpenditure form for approval by the Governor and State Controller

OSC-010 – Under Earned Revenue

Purpose:

This report identifies legal overexpenditures due to underearning of cash, reappropriated, or federal revenue in the general fund, capital construction fund, or information technology capital account.

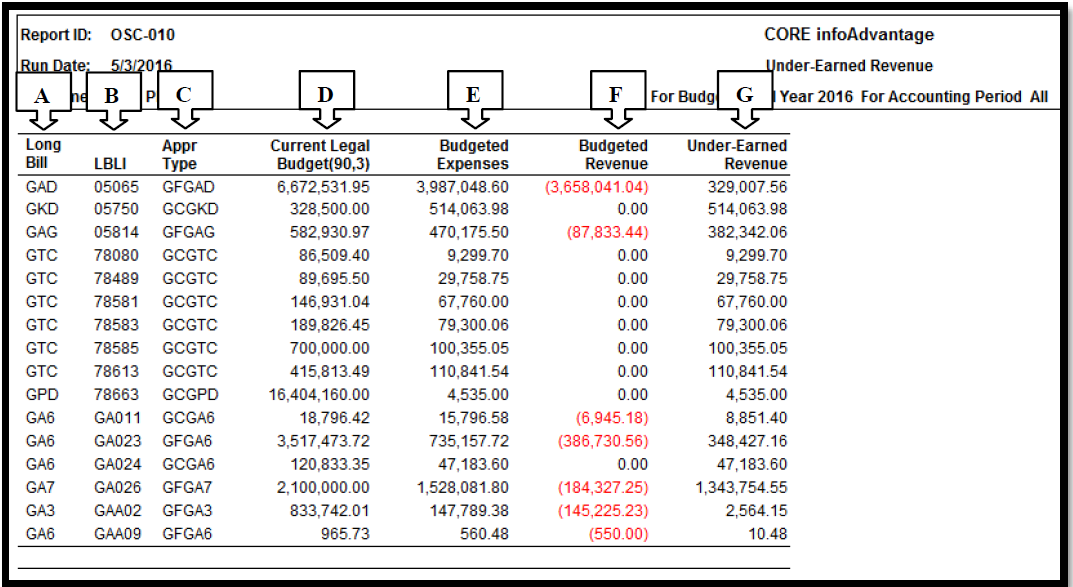

Sample report from infoAdvantage:

The following table describes the information provided on the report:

| Item | Description |

|---|---|

| A | Long Bill: Long bill group (last three characters of appropriation group code). |

| B | LBLI: Long bill line item number (last four characters of appropriation class code). |

| C | Appr Type: Appropriation type code. |

| D | Current Legal Budget: Legal budget as of the report run date. |

| E | Budgeted Expenses: Budgeted expenses through the period of the report. |

| F | Budgeted Revenue: Budgeted revenue through the period of the report. |

| G | Under-Earned Revenue: Budgeted expenses in excess of budgeted revenue. |

How to read this report:

Any item listed on this report is a problem. Items listed on the report should be researched and any necessary corrections should be made.

Possible actions include:

- Reclassify expenses to another budget line

- Reclassify budgeted expenses to nonbudgeted (if appropriate, e.g. higher education, compensated absences, general fund paydate shift, etc.)

- Reclassify or record revenue, including 9523 revenue

- Submit an overexpenditure form for approval by the Governor and State Controller

OSC-011 – IHE Capital Transfers Compared to Expenditures

Purpose:

This report compares transfers from the Capital Construction Fund to the Higher Education Fund expenses recorded for the project (excluding the 6610 Capital Clearing Offset). This report also compares the balance in the 6610 Capital Clearing Offset account to the Higher Education Fund expenses recorded for the project.

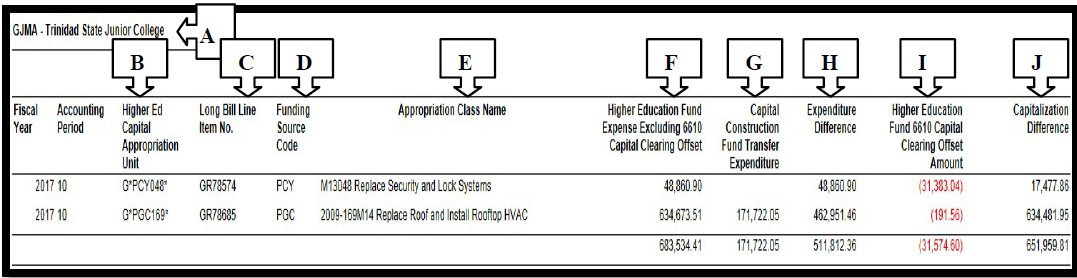

Sample report from infoAdvantage:

The following table describes the information provided on the report:

| Item | Description |

|---|---|

| A | Department code and name. |

| B | Higher Ed Capital Appropriation Unit: Appropriation unit used in Capital Construction Fund and Higher Education Fund. |

| C | Long Bill Line Item No.: Appropriation class code. |

| D | Funding Source Code: Funding source code (last three characters of appropriation type code). |

| E | Appropriation Class Name: Appropriation class code name. |

| F | Higher Education Fund Expense Excluding 6610 Capital Clearing Offset: Project expenses recorded in the higher education fund. |

| G | Capital Construction Fund Transfer Expenditure: Transfers from the Capital Construction Fund to the Higher Education Fund to support project expenses in the Higher Education Fund. |

| H | Expenditure Difference: Deficit/(Excess) transfers from the Capital Construction Fund to the Higher Education Fund (Item F minus Item G). |

| I | Higher Education Fund 6610 Capital Clearing Offset Amount: 6610 balance for the project. |

| J | Capitalization Difference: The difference between 6610 balance and total project expenses excluding 6610 (Item F minus Item I). |

How to read this report:

Any amounts in the Expenditure Difference or Capitalization Difference columns are possible problems. Items listed on the report should be researched and any necessary corrections should be made.

Appropriate Capitalization Differences may exist due to non-capitalized project expenses or due to the Institution of Higher Education not using the 6610 Capital Clearing Offset account in Colorado Operations Resource Engine (CORE). The department should be prepared to explain any balances remaining at the end of the fiscal year to either the OSC or the department’s auditors.

Possible actions include:

- Record an entry to correct the balance

- Explain the balance (e.g., “$X of the project expenses were not capitalized” or “6610 Capital Clearing Offset account is not used by this IHE”)

OSC-012 – Transfer Balancing – Other Cabinet

Purpose:

This report balances transfers across cabinets. Transfers must be in balance prior to fiscal year end close for financial statement elimination and presentation. Transfers are shown on multiple tabs to better facilitate balancing and analysis.

| Tab | Description |

|---|---|

| Interfund Transfers | Balances transfers recorded using the interfund transfer codes. |

| Intrafund Transfers | Balances transfers recorded using the intrafund transfer codes. |

| FML HE Payments to Treasury | Balances transfers recorded using the higher education Certificates of Participation (COP) transfer codes. This tab should only apply to higher education and Treasury, unless used by another cabinet in error. |

| Transfers Into GF | Balances transfers recorded using the general fund transfer codes. |

| Transfer Out of GF Surplus | Balances transfers recorded using general fund surplus transfer codes. |

| HUTF Transfers | Balances transfers recorded using the Highway Users Tax Fund transfer codes. This tab generally only applies to Treasury and cabinets receiving appropriations from the HUTF. |

| By FCAT | This tab is used by the OSC. |

OSC-012 – Interfund Transfers tab

Purpose of this tab:

This tab of the report balances interfund transfers across cabinets. Transfers should be properly classified as interfund and intrafund and this tab reflects balances in the interfund transfer codes. The inter and intra fund classification should be based on the FCAT of each fund (i.e. transfers from G100 to I500 should be classified as interfund).

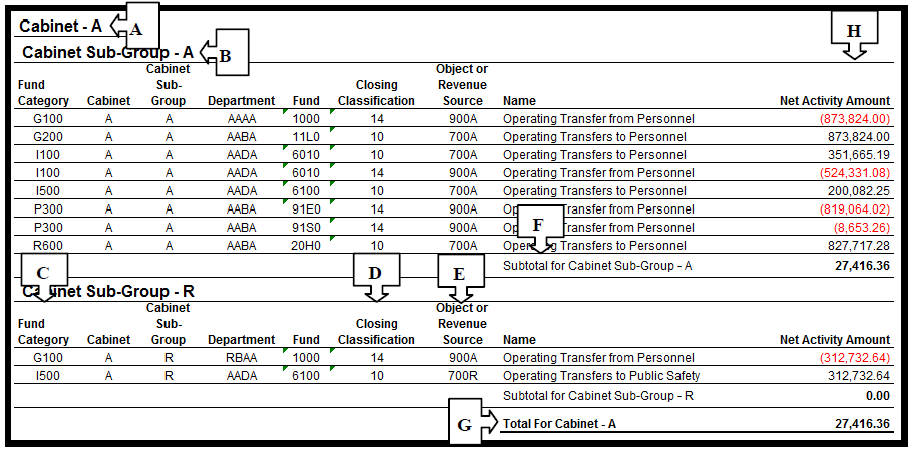

Sample report from infoAdvantage:

The following table describes the information provided on the tab:

| Item | Description |

|---|---|

| A | Cabinet: Cabinet code of the revenue/transfer in recording cabinet |

| B | Cabinet Sub-Group: Cabinet code of the expense/transfer out recording cabinet based on the last character of the transfer out object code |

| C | Fund Category: Fund category from the FUND table for the associated fund. Interfund transfer codes should only be used if the transfer crosses fund categories. |

| D | Closing Classification: Closing classification of the balance. |

| E | Object or Revenue Source: The transfer out object code or transfer in revenue source code for the balance. |

| F | Subtotal for Cabinet Sub-Group: Total of net activity between the cabinet and cabinet sub- group should be $0.00. |

| G | Total For Cabinet: Total of net activity of all cabinet sub-groups for the cabinet should be $0.00. |

| H | Net Activity Amount: Net of the total debits and credits posted to the chart of account string. |

How to read this report:

Total for Cabinet should be $0.00. Cabinet Sub-Group subtotals can be used to determine which transfers are out of balance. In the example above, the total is out of balance by $27,416.36. Cabinet Sub-Group –

R is in balance ($0.00) and the difference is attributable to Cabinet Sub-Group A (see next tab for possible resolution of this example). Cabinets should work together to determine which side of the transfer is out of balance. Inter and intra fund transfers should be appropriately classified. The interfund transfer codes should only be used when crossing fund categories.

Possible actions include:

- Review transfers in to ensure they are correctly recorded and make correcting entries, if needed

- Contact the other cabinet, if applicable, to ensure the transfers out are correctly recorded

OSC-012 – Intrafund Transfers tab

Purpose of this tab:

This tab of the report balances intrafund transfers across cabinets. Transfers should be properly classified as interfund and intrafund and this tab reflects balances in the intrafund transfer codes. The inter and intra fund classification should be based on the FCAT of each fund (i.e. transfers from G100 to G100 should be classified as interfund).

Sample report from infoAdvantage:

The following table describes the information provided on the tab:

| Item | Description |

|---|---|

| A | Cabinet: Cabinet code of the revenue/transfer in recording cabinet |

| B | Cabinet Sub-Group: Cabinet code of the expense/transfer out recording cabinet based on the last character of the transfer out object code |

| C | Fund Category: Fund category from the FUND table for the associated fund. Intrafund transfer codes should only be used if the transfer is within the same fund category. |

| D | Closing Classification: Closing classification of the balance. |

| E | Object or Revenue Source: The transfer out object code or transfer in revenue source code for the balance. |

| F | Subtotal by FCat: Total of net activity within the FCAT should be $0.00. |

| G | Total For Cabinet: Total of net activity of all cabinet sub-groups and FCATs for the cabinet should be $0.00. |

| H | Net Activity Amount: Net of the total debits and credits posted to the chart of account string. |

How to read this tab:

Total for Cabinet should be $0.00. Cabinet Sub-Group and FCAT subtotals can be used to determine which transfers are out of balance. In the example above, the total is out of balance by ($27,416.36). The difference is attributable to Cabinet Sub-Group A and FCAT I100. This amount offsets the difference on the example interfund report indicating a mismatch between the transfer codes used. One side of the transfer was recorded to an interfund code while the other was recorded to intrafund. Cabinets should work together to determine which side of the transfer is out of balance. Inter and intra fund transfers should be appropriately classified. The intrafund transfer codes should only be used within the same FCAT.

Possible actions include:

Review transfers in to ensure they are correctly recorded and make correcting entries, if needed

Contact the other cabinet, if applicable, to ensure the transfers out are correctly recorded

OSC-012 – FML HE Payments to Treasury tab

Purpose of this tab:

This tab of the report balances higher education federal mineral lease Certificates of Participation (COP) payments to Treasury. Transfers should be properly classified as principal and interest and should balance.

Sample report from infoAdvantage:

The following table describes the information provided on the tab:

| Item | Description |

|---|---|

| A | Principal/Interest: The type of transfer. |

| B | Closing Classification: Closing classification of the balance. |

| C | Object or Revenue Source: The transfer out object code or transfer in revenue source code for the balance. |

| D | Net Activity Amount: Net of the total debits and credits posted to the chart of account string. |

| E | Sum: Total of net activity posted to principal or interest transfer codes should be $0.00. |

| F | Grand Total: Total of net activity within the FML payments transfer codes should be $0.00. |

How to read this tab:

The grand total should be $0.00. If it is not, either the principal or interest transfers are out of balance.

Possible actions include:

Review transfers to ensure they are correctly recorded and make correcting entries

Coordinate with Treasury

OSC-012 – GF and HUTF tabs

Purpose of these tabs:

The Transfers Into GF, Transfers Out of GF Surplus, and HUTF Transfers tabs function in similar ways. These tabs of the report balance general fund and HUTF transfers. Transfers should be properly classified as general fund or HUTF.

Sample report from infoAdvantage:

The following table describes the information provided on the tabs:

| Item | Description |

|---|---|

| A | Transfer In/Transfers Out: The tabs are divided between transfers in and transfers out. |

| B | Closing Classification: Closing classification of the balance. |

| C | Object or Revenue Source: The transfer out object code or transfer in revenue source code for the balance. |

| D | Net Activity Amount: Net of the total debits and credits posted each side of the transfer. |

| E | Sum: Total of net activity posted to principal or interest transfer codes should be $0.00. |

| F | Grand Total: Total of net activity within the transfer codes should be $0.00. |

How to read this tab:

The grand total should be $0.00. If it is not, a transfer balance is recorded incorrectly or has not yet been posted.

Possible actions include:

- Review transfers to ensure they are correctly recorded and make correcting entries

- If cabinet has recorded HUTF transfers, but does not receive HUTF appropriations, may need to correct the balance to a different transfer code

- Coordinate with Treasury

OSC-013 – Transfer Balancing – Same Cabinet

Purpose:

This report balances transfers within the cabinet. Transfers must be in balance prior to fiscal year end close for financial statement elimination and presentation. Transfers are shown on multiple tabs to better facilitate balancing and analysis.

| Tab | Description |

|---|---|

| Interfund Transfers | Balances transfers recorded using the interfund transfer codes. |

| Intrafund Transfers | Balances transfers recorded using the intrafund transfer codes. |

| Indirect Costs | Balances transfers recorded using the indirect costs transfer code. |

| By FCAT | This tab is used by the OSC. |

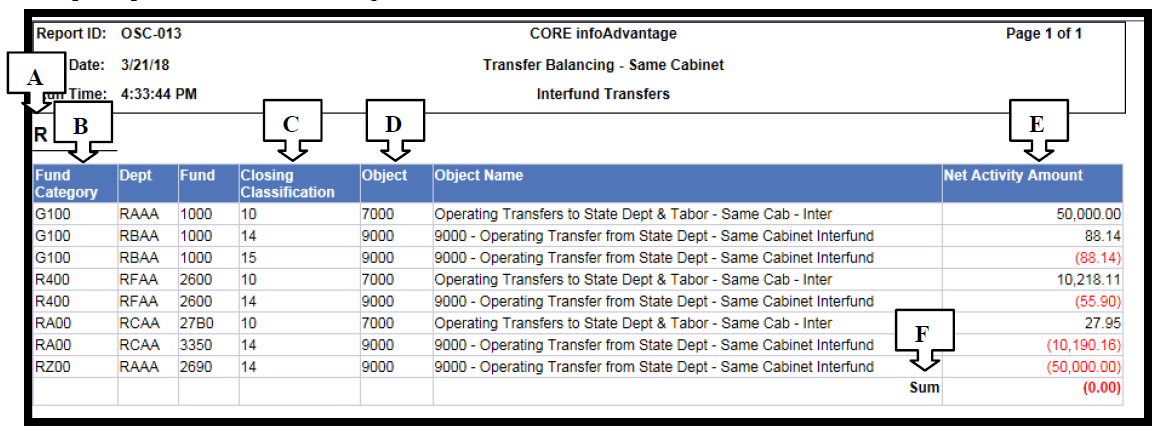

OSC-013 – Interfund Transfers & OSC-013 – Intrafund Transfers tab

Purpose of this tab:

This tab of the report balances interfund transfers within the same cabinet. Transfers should be properly classified as interfund and intrafund and this tab reflects balances in the interfund transfer codes. The inter and intrafund classification should be based on the FCAT of each fund (i.e. transfers from G100 to I500 should be classified as interfund).

Sample report from infoAdvantage:

The following table describes the information provided on the tabs:

| Item | Description |

|---|---|

| A | Cabinet: Cabinet code |

| B | Fund Category: Fund category from the FUND table for the associated fund. Intrafund transfer codes should only be used if the transfer is within the same fund category. |

| C | Closing Classification: Closing classification of the balance. |

| D | Object: The transfer out object code or transfer in revenue source code for the balance. |

| E | Net Activity Amount: Net of the total debits and credits posted each side of the transfer. |

| F | Sum: Total of net activity posted should be $0.00. |

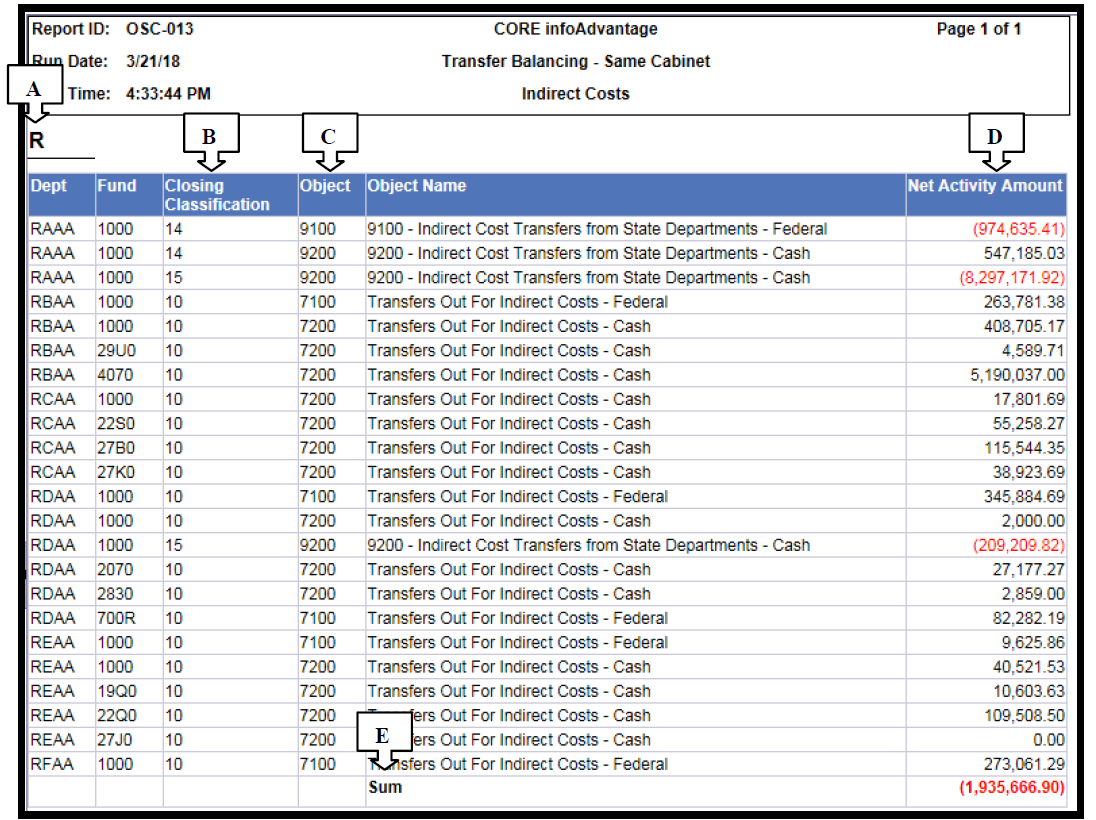

OSC-013 – Indirect Costs tab

Purpose of this tab:

This tab of the report balances indirect costs transfers within the same cabinet. Sample report from infoAdvantage:

The following table describes the information provided on the tabs:

| Item | Description |

|---|---|

| A | Cabinet: Cabinet code |

| B | Closing Classification: Closing classification of the balance. |

| C | Object: The transfer out object code or transfer in revenue source code for the balance. |

| D | Net Activity Amount: Net of the total debits and credits posted each side of the transfer. |

| E | Sum: Total of net activity posted should be $0.00. |

OSC-014 – Transfer Balancing – Higher Education

Purpose:

This report balances transfers recorded using the higher education transfer codes. Transfers must be in balance prior to fiscal year end close for financial statement elimination and presentation. Transfers are shown on multiple tabs to better facilitate balancing and analysis.

| Tab | Description |

|---|---|

| Student Financial Aid | Balances transfers between Department of Higher Education (DHE) and IHEs recorded using the financial aid transfer codes. |

| HE Same Gov Board | Balances transfers within the same governing board. |

| HE Other Gov Board | Balances transfers between different governing boards. |

| AHEC LB Transfers | Balances AHEC long bill transfers. |

| FML COP Payments to AHEC | Balances FMP Certificates of Participation (COP) payments to AHEC. |

| HE State Approps | Balances transfers recorded using the state appropriations transfer codes. |

| HE Capital Construction Transfers | Balances higher education capital construction transfers. |

| By FCAT | This tab is used by the OSC. |

OSC-014 – Student Financial Aid tab

Purpose of this tab:

This tab of the report balances financial aid transfers between the Department of Higher Education and the Institutions of Higher Education. Sample report from infoAdvantage:

The following table describes the information provided on the tab:

| Item | Description |

|---|---|

| A | Dept: Department code |

| B | Object: The transfer code (either object or revenue). |

| C | Net Activity Amount: Net of the total debits and credits posted each side of the transfer. |

| D | Sum: Total of net activity posted should be $0.00. |

How to read this tab:

The sum should be $0.00. If it is not, either the Department of Higher Education or an institution is out of balance.

Possible actions include:

- Review transfers to ensure they are correctly recorded and make correcting entries

- Coordinate with Department of Higher Education

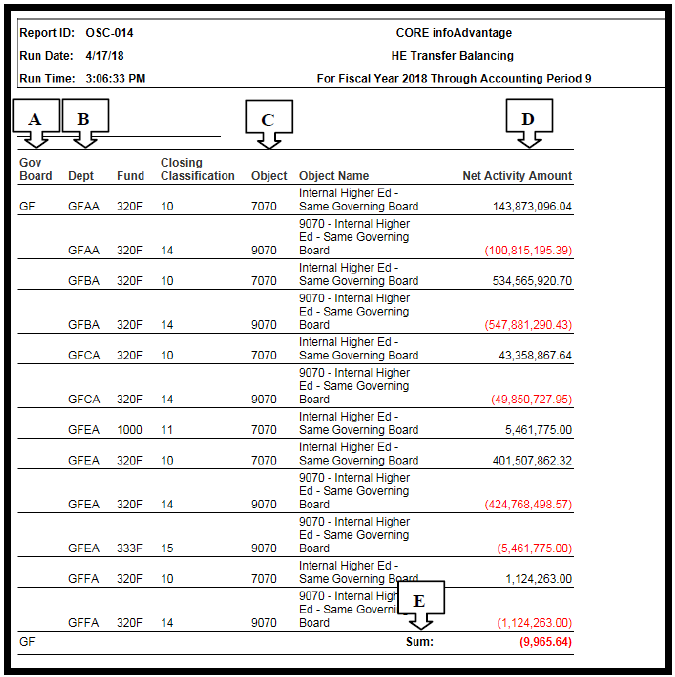

OSC-014 – HE Same Gov Board tab

Purpose of this tab:

This tab of the report balances transfers within the same governing board. The governing board on this report is defined as the first two characters of the department code. Sample report from infoAdvantage:

The following table describes the information provided on the tab:

| Item | Description |

|---|---|

| A | Gov Board: The governing board indicator. This is the first two characters of the department code. |

| B | Dept: Department code |

| C | Object: The transfer code (either object or revenue). |

| D | Net Activity Amount: Net of the total debits and credits posted each side of the transfer. |

| D | Sum: Total of net activity posted should be $0.00. |

How to read this tab:

The sum should be $0.00. If it is not, a transfer balance is recorded incorrectly or has not yet been posted.

Possible actions include:

Review transfers to ensure they are correctly recorded and make correcting entries

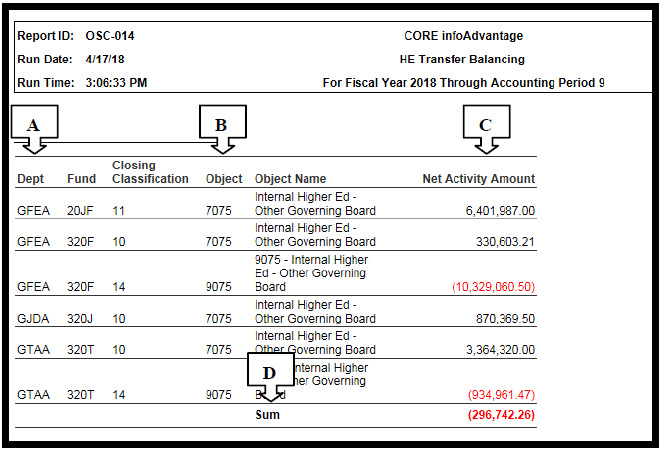

OSC-014 – HE Other Gov Board tab

Purpose of this tab:

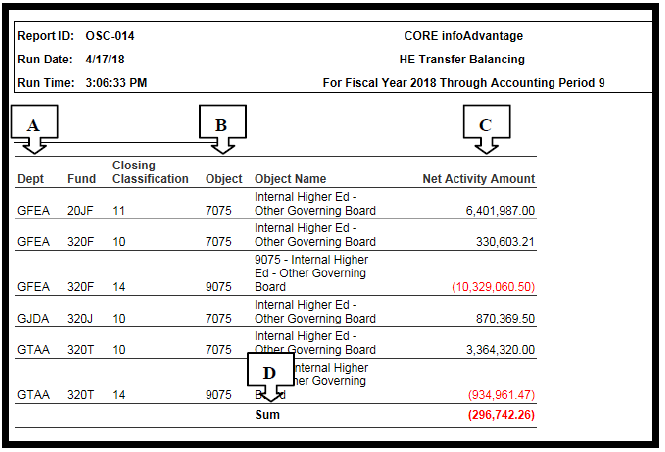

This tab of the report balances transfers between governing boards. Sample report from infoAdvantage:

The following table describes the information provided on the tab:

| Item | Description |

|---|---|

| A | Dept: Department code |

| B | Object: The transfer code (either object or revenue). |

| C | Net Activity Amount: Net of the total debits and credits posted each side of the transfer. |

| D | Sum: Total of net activity posted should be $0.00. |

How to read this tab:

The sum should be $0.00. If it is not, a transfer balance is recorded incorrectly or has not yet been posted.

Possible actions include:

- Review transfers to ensure they are correctly recorded and make correcting entries

- Coordinate with other institutions to determine which transfer is out of balance

OSC-014 – AHEC LB Transfers, AHEC Non-LB Transfers, & FML COP Payments to AHEC tabs

Purpose of these tabs:

This tab of the report balances AHEC long bill and non-long bill transfers. Sample report from infoAdvantage:

The following table describes the information provided on the tab:

| Item | Description |

|---|---|

| A | Dept: Department code |

| B | Object: The transfer code (either object or revenue). |

| C | Net Activity Amount: Net of the total debits and credits posted each side of the transfer. |

| D | Sum: Total of net activity posted should be $0.00. |

How to read this tab:

The sum should be $0.00. If it is not, a transfer balance is recorded incorrectly or has not yet been posted.

Possible actions include:

- Review transfers to ensure they are correctly recorded and make correcting entries

- Coordinate with other institutions to determine which transfer is out of balance

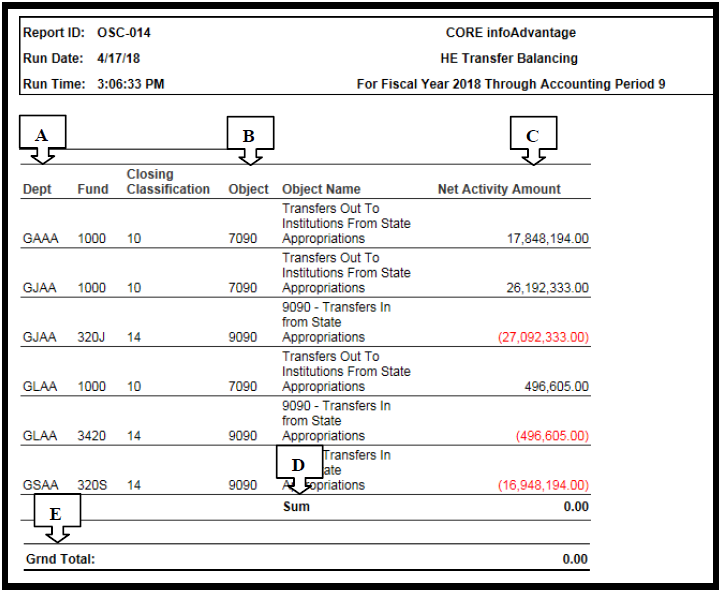

OSC-014 – HE State Approps tab

Purpose of this tab:

This tab of the report balances transfers within the same governing board. The governing board on this report is defined as the first two characters of the department code. Sample report from infoAdvantage:

The following table describes the information provided on the tab:

| Item | Description |

|---|---|

| A | Dept: Department code |

| B | Object: The transfer code (either object or revenue). |

| C | Net Activity Amount: Net of the total debits and credits posted each side of the transfer. |

| D | Sum: Total of net activity posted should be $0.00. |

| E | Grand Total: Total of net activity posted should be $0.00. |

How to read this tab:

The sum and grand total should be $0.00. If it is not, a transfer balance is recorded incorrectly or has not yet been posted.

Possible actions include:

- Review transfers to ensure they are correctly recorded and make correcting entries

- Coordinate with other institutions to determine which transfer is out of balance

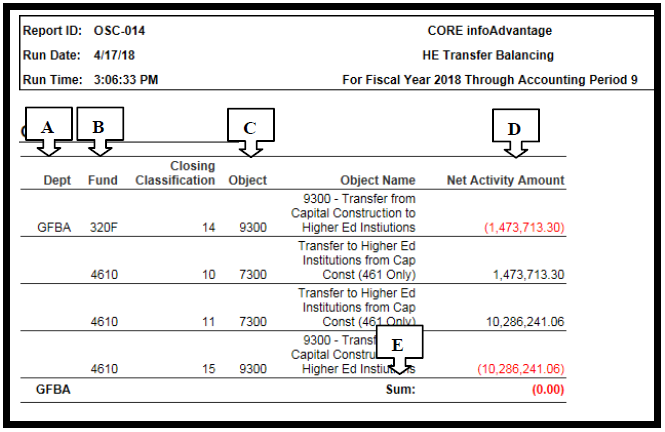

OSC-014 – HE Capital Construction Transfers tab

Purpose of this tab:

This tab of the report balances capital construction transfers by department code. Sample report from infoAdvantage:

The following table describes the information provided on the tab:

| Item | Description |

|---|---|

| A | Dept: Department code |

| B | Fund: Fund code |

| C | Object: The transfer code (either object or revenue). |

| D | Net Activity Amount: Net of the total debits and credits posted each side of the transfer. |

| E | Sum: Total of net activity posted to each department code should be $0.00. |

How to read this tab:

The sum by department code should be $0.00. If it is not, a transfer balance is recorded incorrectly or has not yet been posted.

Possible actions include:

Review transfers to ensure they are correctly recorded and make correcting entries

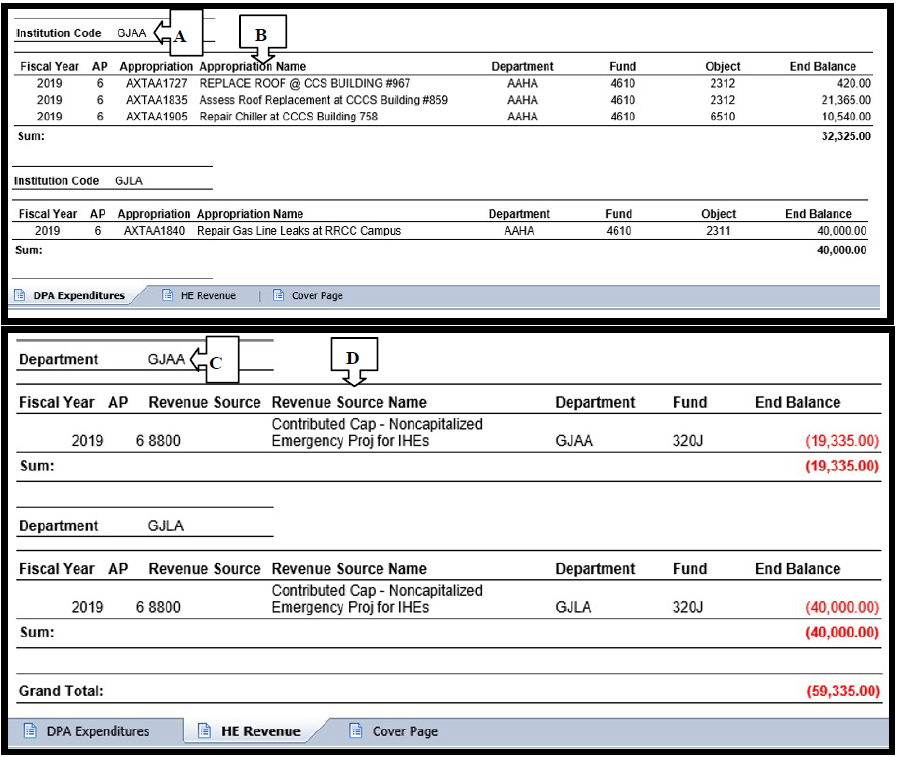

OSC-015 – IHE Noncapitalizable Emergency Projects

Purpose:

This report compares DPA emergency maintenance funds distributions and the contributed capital revenue recorded by higher education institutions.

Sample report from infoAdvantage:

The following table describes the information provided on the tab:

| Item | Description |

|---|---|

| A | Institution Code: Department code of the institution of higher education for this project. |

| B | Project expenses recorded by the Department of Personnel & Administration. |

| C | Department: Department code the institution of higher education recording revenue. |

| D | Contributed capital revenue recorded by the institution of higher education. |

How to read this report:

The Office of the State Architect and DPA accounting office notify the OSC of projects that should be included on this report. Institutions of Higher Education should record matching contributed capital revenue

for these projects to support the calculation of state support for Taxpayer Bill of Rights (TABOR) purposes. At the end of the year, DPA’s expenditures on the first tab of the report should equal the institution’s amount recorded as contributed capital on the second tab. Additional information on this process is available in Chapter 4, Section 1 of the Fiscal Procedures Manual.

Possible actions include:

- Institutions of Higher Education record contributed capital revenue

- Coordinate with DPA accounting on determination of whether project is capitalized

OSC-016 – Unbudgeted Posting Codes

Purpose:

This report contains a summary of unbudgeted expenditures and revenues to allow for identification of potential problems such as improper use of unbudgeted posting codes or missing unbudgeted entries.

Sample report from infoAdvantage:

The following table describes the information provided on the report:

| Item | Description |

|---|---|

| A | Posting Code: Unbudgeted posting code. |

| B | Event Type: Event type, if any, used on the transaction. |

How to read this report:

Balances on this report should be reviewed for the appropriate use of budgeted posting codes identified in the Fiscal Procedures Manual (such as fund 4710 entries, Treasury transaction fees, fund balance budget authority, etc.). Transactions that should be recorded as budgeted should not be present on this report.

Additionally, this report can be used to assess whether all non-budgeted entries have been completed by year end close.

Possible actions include:

- Reclassify balances to budgeted, if necessary

- Record missing non-budgeted entries

OSC-018 – Exhibit Reconciling Balances

Purpose:

This report provides Colorado Operations Resource Enging (CORE) balances expected to tie to year-end exhibits submitted by departments to the OSC. Sample report from infoAdvantage:

The following table describes the information provided on the report:

| Item | Description |

|---|---|

| A | CORE balance expected to tie to a part of the exhibit. |

| B | Tabs for each exhibit expected to tie to CORE balances. |

How to read this report:

Balances on this report should be reviewed for accuracy during preparation of department exhibits. If exhibits do not tie to these balances, the OSC may contact the department to request a correcting entry or corrected exhibit. This report should be run throughout close, especially if a department has submitted post- closing entries that may require a revised exhibit to be submitted. Information about how complete each exhibit can be found in the Exhibit Instructions published by the OSC each year.

Possible actions include:

- Submit an entry to correct the CORE balance

- Submit a revised exhibit

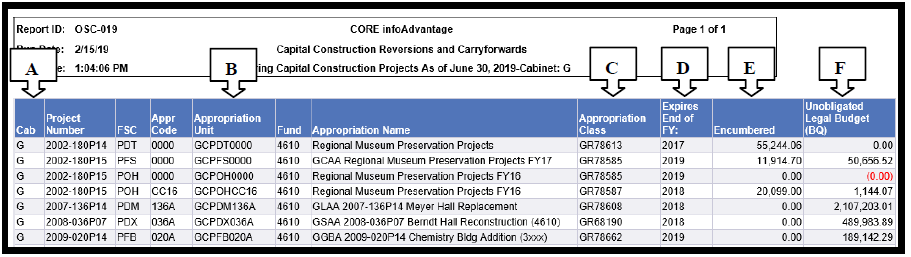

OSC-019 – Capital Construction Reversions and Carryforwards

Purpose:

This report provides a listing of both the expiring and continuing capital construction projects. Projects expire after three years unless valid encumbrances exist as of June 30 of the year of expiration or the date is extended by the General Assembly.

Sample report from infoAdvantage:

The following table describes the information provided on the report:

| Item | Description |

|---|---|

| A | Project Number: Project number assigned by the Capital Development Committee staff of the General Assembly. |

| B | Appropriation Unit: Appropriation unit used for the project or portion of the project. |

| C | Appropriation Class: Appropriation class rollup for the appropriation unit. |

| D | Expires End of FY: Project and appropriation expire at the end of this fiscal year. The project expiration date is maintained in the short name field of the appropriation class table. |

| E | Encumbered: Encumbrances against the project recorded in CORE. |

| F | Unobligated Legal Budget: Remaining balance of the appropriation. |

How to read this report:

The expiring tab of this report show projects that will expire at the end of the fiscal year entered in the prompt or projects that expired in a prior fiscal year, but were extended due to valid encumbrances. Both expiring and continuing projects should be reviewed annually to ensure the expiration date is correct.

Chapter 4, Section 1 of the Fiscal Procedures Manual contains additional information about the carryforward and reversion of capital construction projects.

Possible actions include:

- Carryforward the encumbered portion of expiring projects

- Revert remaining balance on expiring projects

- Notify the OSC (DPA_FARmailbox@state.co.us) if the expiration date has been extended by the General Assembly

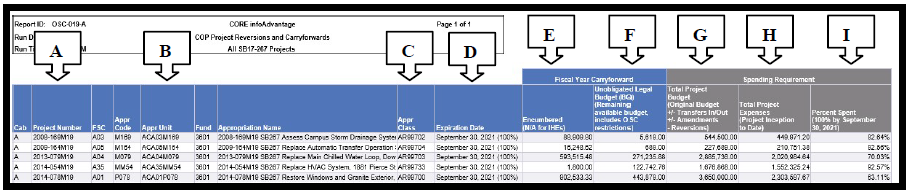

OSC-019-A – Certificates of Participation (COP) Project Reversions and Carryforwards

Purpose:

This report provides a listing of both the expiring and continuing capital construction projects funded with proceeds of certificates of participation (COP). The expiration dates and spending requirements are determined so as to comply with arbitrage requirements and are different that regular capital construction projects reported on the OSC-019 report.

Sample report from infoAdvantage:

The following table describes the information provided on the report:

| Item | Description |

|---|---|

| A | Project Number: Project number assigned by the Capital Development Committee staff of the General Assembly. |

| B | Appropriation Unit: Appropriation unit used for the project or portion of the project. |

| C | Appropriation Class: Appropriation class rollup for the appropriation unit. |

| D | Expiration Date: Project and appropriation expire on this date. The project expiration date is determined according to arbitrage requirements. |

| E | Encumbered: Encumbrances against the project recorded in CORE. |

| F | Unobligated Legal Budget: Remaining available balance of the appropriation. Includes OSC restrictions. |

| G | Total Project Budget: Total budget allocated to the project. This is calculated as original budget + transfers in – transfers out +/- amendments – reversions. |

| H | Total Project Expenses: Total expenses recorded against the project since project inception. This is not the total current year expenses. |

| I | Percent Spent: Percent of the total project budget expended. |

How to read this report:

This report is a tool that should be used by each department and institution of higher education to monitor projects funded by Certificates of Participation (COP) proceeds. Each COP issuance is reported on a separate tab and departments and institutions should review each tab. The fiscal year carryforward columns provide the amount encumbered and the unobligated budget for the current year. The unobligated amount will be carried forward by the OSC as described in the Fiscal Procedures Manual until the expiration date. The spending requirement columns provide the balances used to calculate the percent of the project expended. COP projects must be managed to comply with arbitrage and generally must be 85% spent within three years and 100% spent within five years, unless otherwise stated on this report. For example, SB17-267 projects must be 100% spent within three years.

Possible actions include:

- Coordinate with procurement and facilities offices to ensure projects are being encumbered and finished in a timely manner

- Communicate the unique requirements of these projects to the appropriate individuals in the department

- Contact the Office of the State Architect to reallocate funds to/from another project if needed

- Revert remaining balance on finished projects

OSC-021 – Split Funded Capital Construction Projects

Purpose:

This report provides a summary of capital construction expenditures expressed as a percentage of the project budget. Projects with multiple funding sources should be spent proportionally except for projects at Institutions of Higher Education which are exempt from proportional spending.

Sample report from infoAdvantage:

The following table describes the information provided on the report:

| Item | Description |

|---|---|

| A | FSC: Funding source code for the project. |

| B | FSC Name: Project name from the appropriation unit table. |

| C | GCF Indicator: GCF indicator for each funding source. |

| D | Current Legal Budget: Current legal budget for the funding source. |

| E | Budgeted Expenditures: Expenditures recorded against each funding source. |

| F | % Budget: Percentage of total budget allocated to each funding source. |

| G | % Expense: Percentage of total expenses charged to each funding source. |

How to read this report:

The “% Budget” and “% Expense” columns should be the same or relatively similar, except for Institutions of Higher Education which are exempt from proportional spending. A single funding source (e.g., cash or federal) may be split into two different lines on this report. This is due to different appropriation unit names for the same funding source. In this situation, the project needs to be evaluated manually or the appropriation unit names changed to be the same.

Possible actions include:

- Reclassify expenses between funding sources for the project to achieve proportional spending

- If the same funding source is split between two different lines, change the appropriation unit names to be consistent and re-run the report the following day or evaluate the project manually

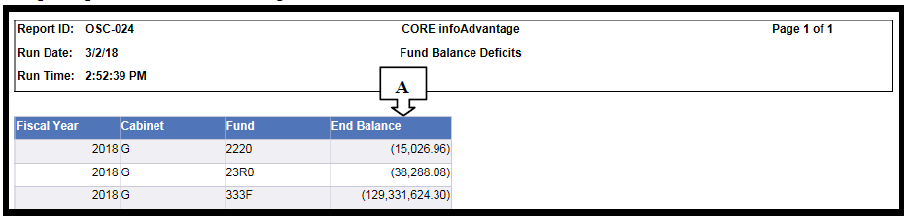

OSC-024 – Fund Balance Deficits

Purpose:

This report lists funds with deficit fund balances at the cabinet code level. The second tab on this report shows fund balances for all funds, whether in a deficit position or not and provides the department code level balances. As deficit fund balances are treated as overexpenditures, this report excludes pension balances and OSC use only department codes (department codes with X as the second character).

Sample report from infoAdvantage:

The following table describes the information provided on the report:

| Item | Description |

|---|---|

| A | End Balance: Ending calculated net assets (total assets less total liabilities) for theaccounting period selected in the prompt excluding pension and OSC use only department code balances. |

How to read this report:

Any item listed on the “By Cabinet” tab of this report is potentially a problem as the fund is in a deficit position. The “Fund Balances for All Funds” tab of this report provides department code level detail which may be helpful in researching deficits. Note that this report may not tie to the fund balance amount recorded on the general ledger as that balance is only updated during the final fiscal year end close when the nominal account balances are closed into fund balance whereas the balance presented on the OSC-024 is calculated using the asset and liability balances through the prior day.

Possible actions include:

- Request revenue from the department responsible for the fund (if deficit is related topositive coding)

- Submit an overexpenditure request form

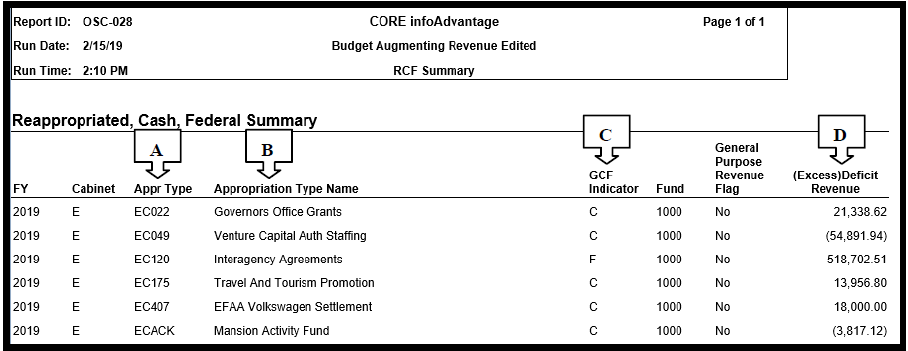

OSC-028 – Budget Augmenting Revenue

Purpose:

This report identifies revenue in excess of expenditures in cash, federal, and reappropriated appropriations in the general fund. Excess revenue is reverted to the general fund at the end of each fiscal year.

Sample report from infoAdvantage:

The following table describes the information provided on the report:

| Item | Description |

|---|---|

| A | Appr Type: Appropriation type with excess or deficit revenue. |

| B | Appropriation Type Name: Name from the appropriation type table. |

| C | GCF Indicator: GCF indicator from the appropriation type code. |

| E | (Excess) Deficit Revenue: Revenue in (excess) or deficit of expenditures. |

How to read this report:

Any item listed on this report is potentially a problem that should be researched. Excess revenue is reverted to the general fund balance at the end of the fiscal year. Deficit revenue results in an overexpenditure situation (see the OSC-010 for discussion on deficit revenue).

Possible actions include:

- Reclassify revenue to another budget line

- Reclassify or record revenue, including 9523 revenue

- Notify OSC Financial Specialist if excess revenue is correct and it should revert

OSC-031 – Average Daily Cash Deficit Balance by Calendar Months in a Quarter

Purpose:

This report lists average daily cash deficit balances by calendar months in a quarter for funds at the cabinet level, excluding fund 1000, 4610, and 4611. It also includes cash and fund balances by the fiscal quarter-end. This report assists departments on assessing each of their activities’ working capital needs and reviewing cash account balances on an ongoing basis to identify accounts where an approved loan or advance is or may be required at the end of the fiscal year.

For year-end reporting, the OSC will provide a workbook and a Loan & Advance request form to departments to complete for any cash deficits remaining in period 16.

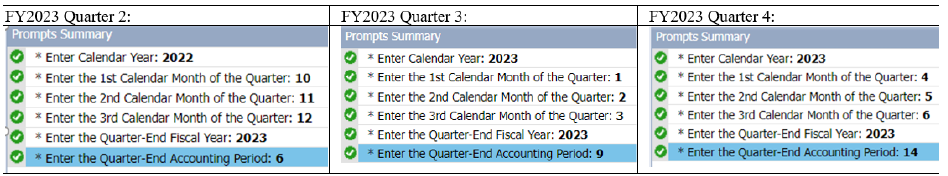

Example of prompts to run the report:

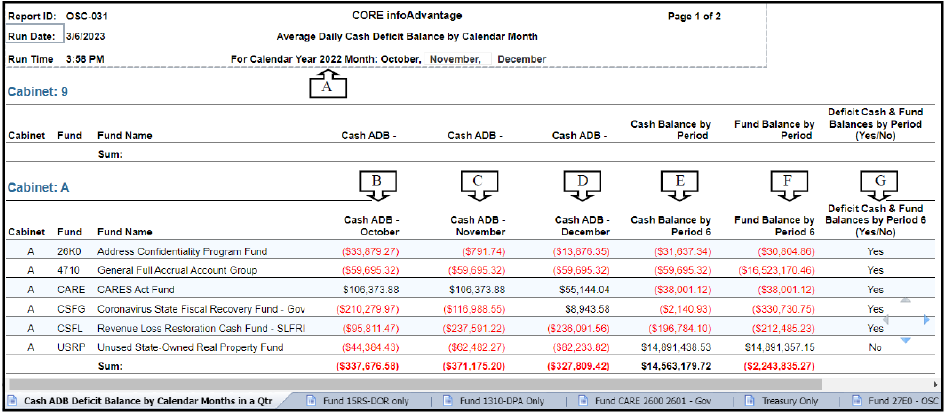

Sample report from infoAdvantage:

The following table describes the information provided on the report:

| Item | Description |

|---|---|

| A | Calendar Year: Calendar year |

| B | Cash ADB - 1st Calendar month: Amount of the average daily cash balance in the 1st calendar month of the quarter. |

| C | Cash ADB – 2nd Calendar month: Amount of the average daily cash balance in the 2nd calendar month of the quarter. |

| D | Cash ADB – 3rd Calendar month: Amount of the average daily cash balance in the 3rd calendar month of the quarter. |

| E | Cash Balance by Period: Cash balance by the period of the quarter-end. |

| F | Fund Balance by Period: Fund balance by the period of the quarter-end. |

| G | Deficit Cash & Fund Balances by Period (Yes/No): Indicating whether the fund has both deficit cash and fund balances by the period of the quarter-end. |

How to read this report:

1st Tab: Cash ADB Deficit Balance by Calendar Months in a Qtr.

Any item listed on the first tab of this report is potentially a problem that should be researched. Necessary actions should be taken to solve cash deficit issues before the fiscal year-end. For funds also analyzed at the fund level (e.g. Marijuana Tax Cash Fund), departments need to work with the responsible state agencies to make sure transfers are completed timely prior to the fiscal year-end. For other funds, a deficit cash balance at the fund/cabinet level indicates the need for a working capital loan or advance.

2nd Tab: Fund 15RS – DOR only

This tab lists the total average daily cash balances of the calendar months, cash and fund balances for fund 15RS by the fiscal period of the selected quarter-end. The Department of Revenue is responsible for reviewing and monitoring fund 15RS cash and fund balances.

3rd Tab: Fund 1310 – DPA only

This tab lists the total average daily cash balances of the calendar months, cash and fund balances for fund 1310 by the fiscal period of the selected quarter-end. The Department of Personnel & Administration is responsible for reviewing and monitoring fund 1310 cash and fund balances.

4th Tab: Fund CARE, 2600, 2601 – Gov.

This tab lists the total average daily cash balances of the calendar months, cash and fund balances for funds Coronavirus Aid, Relief and Economic Security Act (CARE), 2600, and 2601 by the fiscal period of the selected quarter-end. The Governor’s Office is responsible for reviewing and monitoring the cash and fund balances for those funds.

5th Tab: Treasury only

This tab lists the total average daily cash balances of the calendar months, cash and fund balances for funds 3601, 9535, 4300, 8320, 83A0, and 3602 by the fiscal period of the selected quarter-end. Fund 3601 and 9535 are netted because the Certifications of Participation (COP) proceeds reside in Fund 9535 until the monthly reimbursements are made to 3601. Fund 8320 and 83A0 are also netted and make up the Unclaimed Property Tourism Promotion Trust Fund. The Treasury is responsible for reviewing and monitoring the cash and fund balances for those funds.

6th Tab: Fund 27E0 – OSC only

This tab lists the total average daily cash balances of the calendar months, cash and fund balances for fund 27E0 by the fiscal period of the selected quarter-end. The Office of the State Controller is responsible for reviewing and monitoring fund 27E0 cash and fund balances.

Possible actions include:

- Collect Accounts Receivables and make deposits timely

- Reclassify revenue or expenses with cash offset

- Work with the cabinets responsible for the specific funds to complete transfers timely

- Submit Loan or Advance Request form for approval by the Governor, State Controller, and State Treasurer at the end of the fiscal year